Cryptocurrency Winners and Losers. Over the past last year, Cryptocurrency has become a hot investment topic in Guatemala and El Salvador. In a rock concert-like atmosphere, El Salvador President Nayib Bukele announced that his government will build an oceanside “Bitcoin City”. In Guatemala a number of Bitcoin investment advisors surfaced.

I decided to write this post not as a financial advisor only to explain how based purely on math the best strategy for playing in the Cryptocurrency game.

After extensive research, this post offers a simple explanation of how to profit in Cryptocurrency by trading Bitcoin.

Cryptocurrency Winners and Losers. In the Cryptocurrency game, there are two winners, Mining coins if you have a massive data center of computers, if you trade Cryptocurrency each day, as the stock market, both options offer a way to make money.

However, both require investments, data centers to be cost-effective in mining costs millions. Trading you need to have made an investment of at least $5,000 in order to produce profits, buying and selling.

Cryptocurrency consultants and financial advisors create funds for investors, with the hope the consultants can predict the future. This category makes up most of the losers.

The average person with a few thousand dollars trading will provide you with a reasonable return on a $5000 or $10,000 investment trading each day.

Trading Cryptocurrency simple example.

December 12th, 2020 if you owned one Bitcoin worth, $20,000.

April 14th, 2021 one Bitcoin was worth, $64,500.

If you would have sold your one Bitcoin you would have walked away with a $44,500 profit after your original $20,000 investment.

July 20 2021 one Bitcoin was worth $29,000, you buy back in using your profits. Leaving you with a profit of $15,500 from your original investment.

November 8th, 2021 one Bitcoin was worth $67,000 you sell, netting a profit of $38,000 profit.

December 9th, 2021 you buy one Bitcoin for $46.000.

Cryptocurrency Winners and Losers

- Learn what moves bitcoin’s price.

- Pick a bitcoin trading style and strategy.

- Choose how you want to get exposure to bitcoin.

- Decide whether to go long or short.

- Set your stops and limits.

- Open and monitor your trade.

- Close your position to take a profit or cut a loss.

Bitcoin and other Currencies continue to be connected and affected by Stock Markets, even though only 7% of the wealth of the world is in Cryptocurrency.

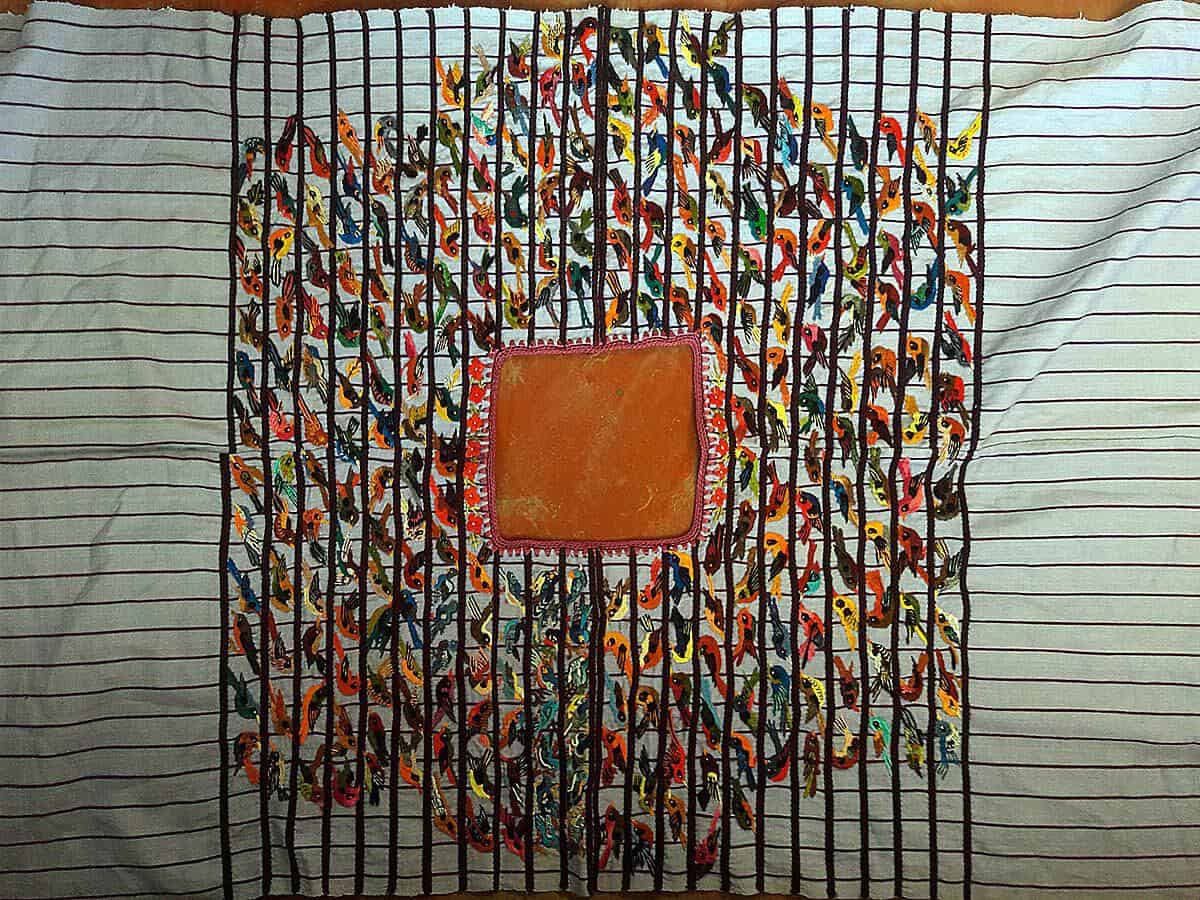

Ethical Fashion Guatemala

Ethical Fashion Guatemala Ethical Fashion Guatemala

Ethical Fashion Guatemala